The exponential growth of emerging medical technologies will likely accelerate over the next few years, particularly in the cardiovascular (CV) service line and, more specifically, within mitral valve (MV) treatments. Transcatheter aortic valve repair (TAVR) recently paved the way for valve-specific CV programs by demonstrating that these business models can succeed in focusing on a specific category of the heart. Additionally, TAVR proved that patients are willing to travel for well-established programs that demonstrate their ability to provide innovative care. Combined with this subspecialization trend is a wave of MV-specific technologies and devices that will likely go to market in the coming years. This combination of factors presents a new opportunity for forward-looking CV service lines.

Untreated Population

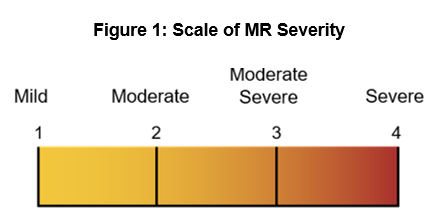

As it stands today, MitraClip is the leading solution used in MV surgery, but it does not serve many variations of MV disease, leaving numerous patients without a viable treatment option. For example, mitral regurgitation (MR), a common variant of MV disease, allows blood to leak backward into the left atrium of the heart and, if not treated, can result in heart muscle damage. MR is graded on a scale of one to four to identify the severity of the disease (see figure 1); grade one is mild regurgitation, and grade four is severe and constant regurgitation. A recent Mayo study indicates that only 15% of MR patients received surgical treatment for the disease; however, one of the limitations of the available solutions is that patients must let the disease progress to a severe state (i.e., MR grade three or four) before interventional treatment becomes viable or even beneficial. To close this care gap, multiple medical device and biotech companies are developing transcatheter interventional solutions to address different grades of MR. As these devices become available, CV service lines will have more opportunities to both provide better patient care and further differentiate themselves.

A New Wave of CV Devices

Three MV devices are in clinical trials or already in use in other countries and are worth keeping an eye on, as they will likely enter the US market in the next few years, depending on clinical trials and FDA approvals. Given use cases, physician preference, and regulatory changes, it is anticipated that transcatheter MV repair (TMVR) will follow many of the same patterns as TAVR and drive meaningful change in cardiology strategies.

1. Mitral Contour System

The Mitral Contour System is a minimally invasive MV failure solution designed to treat patients in earlier stages of the diagnosis (i.e., moderate or MR grade two and above). Cardiac Dimensions, the company behind the new system, has raised $39 million in additional financing rounds and expects its solution will successfully pass through the clinical trials phase and enter production before 2021. This would allow for patients to receive treatment before they require surgical MV repair or qualify for other therapies. This product is in late-stage clinical trials and is reporting success.

2. Cardioband Mitral Reconstruction System

Edwards Lifesciences Corporation recently purchased Valtech Cardio for $340 million at closing, with an additional $350 million available contingent on ongoing milestones. One reason for the purchase was Edwards Lifesciences’ interest in the Cardioband technology, now known as the Edwards Cardioband Mitral Reconstruction System. Valtech Cardio originally designed this transcatheter device to wrap around the MV to allow for real-time adjustment to the patient’s conditions. The Cardioband is in use in various countries across the globe for MR grade 2 and above and is currently in clinical trials in the US.

3. Mitralign

Mitralign is another TMVR solution that is showing promise in US clinical trials. The Mitralign device was initially designed to treat MV failure of MR grade three and above, but other use cases are being explored. The core design principle is also being tested in tricuspid valve repair under a product dubbed Trialign.

Replicating TAVR’s Program Development

TMVR clinical programs are the logical next step to TAVR and will provide the opportunity to structure a sustainable CV center of excellence that focuses on MR. Understanding the long- and short-term business implications and emerging strategic opportunities will be key in CV service line planning as new and previously untreated patient populations arise. TAVR, at first, was viewed as a breakeven or losing service line that was necessary for differentiation and recruitment; however, organizations quickly began to recover costs and drive contribution margin to the system. Similarly, TMVR devices and technologies are poised to make long-lasting impacts in the industry. These programs may not be immediately profitable but will be necessary for immediate differentiation and growth. Structural heart procedures are the future of cardiac care, and TMVR is the next step in the progression.

Learn how your service line can incorporate TMVR and other upcoming care advancements into your strategy by connecting with our CV planning experts.