In a previous post, we discussed the recently publicized dropout rates for meaningful use (MU) attestations and the various incentive and penalty scenarios for providers dropping out of the Medicare attestation progression. Dropout rules and scenarios will vary, however, for providers who have attested under the Medicaid incentive program before the end of 2014.

Medicaid Incentive and Penalty Variances

With respect to incentive payments and penalties, the Medicaid program is different from the Medicare incentive program in four distinct ways:

1. There are no penalties on Medicaid payments; penalties for not being a meaningful user in either the Medicaid or Medicare program only affect Medicare payments. Additionally, only providers eligible for both the Medicare and Medicaid EHR incentive programs are subject to payment adjustments (i.e., not nurse practitioners, certified nurse-midwives, or physician assistants).

2. The last year that payments will be available differs between the two programs. Under Medicare, no incentive payments will be made after 2016, whereas eligible professionals (EPs) have until 2021 to earn incentives under Medicaid. Medicaid program EPs can earn up to a total of $63,750 in incentives as long as they start participating by 2016. For each 1-year delay after 2016, the total incentive potential is reduced by $8,500, as no payments will be made after 2021.

3. Medicare and Medicaid treat skipped years differently. Medicare rules keep requirements and payments aligned with the 6 consecutive allowed program years (2011–2016); if an EP skips the second program year and forfeits incentives for that year, they would reenter the program in the third year, with the associated requirements and payments for Year 3. Medicaid participation years and incentive payments, on the other hand, can be non-consecutive with no adverse impact on total available incentive dollars. For example, if an EP skips the second program year and does not receive incentives, he or she would resume reporting in the third program year but according to the Year 2 requirements and could still collect the Year 2 incentive. With 6 total years of incentive payments that can be earned until 2021, there may be scenarios in which skipping years under the Medicaid program is justified. The ultimate goal, in terms of receiving the maximum incentive amount, is to successfully attest a total of five times prior to 2021 so that the final year of the program is also the EP’s sixth reporting year.

4. Eligibility for the Medicaid program is based on the percentage of total visits with Medicaid patients. If Medicaid visits fall below the 30% threshold, EPs may be forced to switch incentive programs because they will no longer be eligible under Medicaid. Pediatricians may still qualify for incentives with volumes below 30%; if Medicaid visits fall between 20% and 30% of the volume threshold, provider incentives are reduced to two-thirds of the payment amount.

Need to Switch From Medicaid to Medicare?

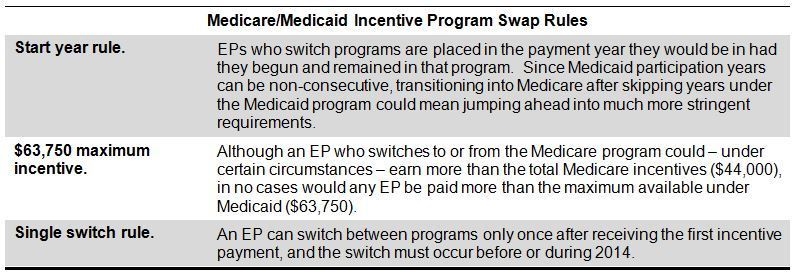

Given the Medicaid threshold for incentive program participation, there are a number of scenarios that could result in an EP switching programs from Medicaid to Medicare. CMS has provided several rules to manage potential program swaps, as outlined in the table below.

Incentive and Penalty Scenarios

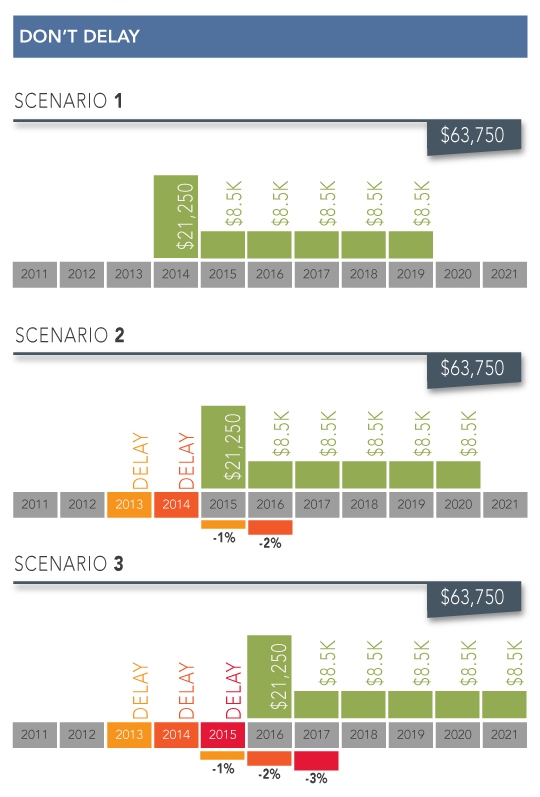

The graphic below outlines different incentive and penalty scenarios for EPs attesting through the Medicaid incentive program who need to either switch to the Medicare program or miss one or more years of Medicaid attestation. This graphic is designed to help delineate the financial impact of dropping in and out of the different programs for providers originally attesting with Medicaid, but does not cover all possible scenarios.