Health systems and physician-owned ambulatory surgery centers (ASCs) alike are seeking strategies to become more integrated and offer new value to patients by providing comprehensive, coordinated services across the healthcare continuum. Additionally, as the growth of outpatient care continues to outpace inpatient growth, particularly in orthopedics, health systems will need to evaluate their current care offerings and determine the level and types of service necessary to remain viable in the future. From the perspective of health system executives, the choices are no less complicated than they are for ASC owners:

- Compete with independent ASCs by providing both inpatient and outpatient services internally.

- Collaborate with an independent ASC, potentially through an ACO or narrow network, to ensure patients have access to comprehensive, coordinated care.

- Purchase all or a majority of an existing ASC to increase alignment and partner with physicians to provide care.

For health system executives, these choices are and will be influenced by a number of factors, including:

- Progress in Building a Continuum of Care – Health systems in markets that are moving aggressively toward accountable care structures may find ASC ownership attractive. ASCs can play a key role in developing a low-cost, high-quality care delivery model focused on preventive care and outpatient services. Controlling such a care continuum will help position health systems for value-based payments.

- Opportunity to Capitalize on HOPD Rates – Health systems with a high volume of government patients will be able to immediately derive enhanced reimbursement from ASCs due to the systems’ ability to seek Medicare reimbursement at 100% of HOPD rates (as opposed to 56% received by physician-owned ASCs). However, MedPAC is promoting the reevaluation of, and potential end to, this payment differential.

- Physician Relationships – Hospitals with strong orthopedic surgeon relationships will likely find success in partnering with or purchasing orthopedic ASCs. Healthcare system executives need to fully understand the referral patterns to their independent orthopedic affiliates. In many instances, the employed primary care network of health systems makes up 80% to 90% of the referrals to independent specialists. Under this scenario, the health system may have leverage to keep the care of the patient base within the network while maintaining high quality, low cost, and the flow of health information.

- Specialty-Focused, Employed Physician Networks – Physicians selling their stake in their ASC typically face a declining income stream and may be interested in combining the sale of the center with employment. Health systems operating strong employed networks with efficient operations and specialty focus will be attractive for surgeons who are wary of joining primary-care-dominated, employed networks.

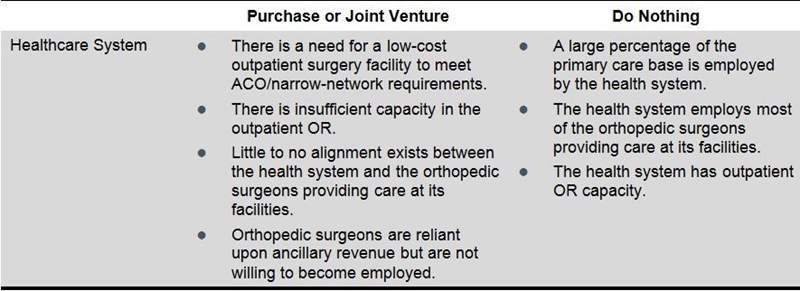

Below is a decision matrix to assist health system executives.

Ultimately, whether partnering with or purchasing an ASC, health systems will need to focus on increasing value to patients by providing coordinated, cost-effective, and high-quality health services.

To learn more, read the original article.