A flurry of health plan transactions took place from 2013 to 2018; 105 plans entered the market and 104 were sold to a larger plan or ceased operations. The rapid pace of health plan acquisition or consolidation, especially for provider-sponsored health plans, is likely to continue.

In an environment of such significant M&A activity, plan owners need to determine an appropriate purchase price when acquiring or divesting a health plan. In this article, we explain how key assumptions affect a valuation, and describe the importance of reaching an achievable financial forecast.

Valuation Methodology

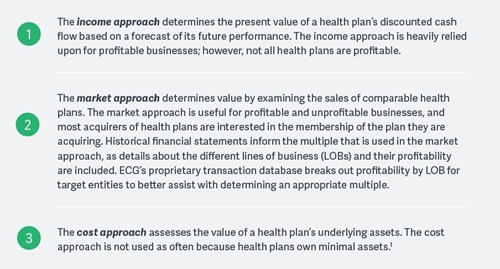

There are three health plan valuation methodologies.

The three methodologies can be used in combination or as a single approach. Each brings nuance to the valuation process, and we will address that further.