Times of Change

After years of rampant speculation, legal challenges, and political jousting, the first waves of the Affordable Care Act (ACA) and healthcare reform are rolling in. What will follow is a sea change for the provision and payment of care. Though a mist of uncertainty still lingers over healthcare regarding the immediate and long-term effects of reform, there is no question that, in the immortal words of Sam Cooke, “a change is gonna come.” And change will keep coming as hospitals and healthcare systems attempt to keep pace with healthcare’s rapidly evolving economic climate.

Much of this change stems from a fundamental shift in incentive structures, in which economic rewards rise and fall with care quality, cost, and access. The migration toward a value-centric payment system will disrupt “business as usual,” forcing healthcare provider organizations to adjust to reimbursement models and incentives that are based on shared savings and risk rather than volume. Determining how to navigate this transition successfully – and in a financially responsible manner – is one of the greatest challenges organizations face as they enter a new healthcare era. A range of reactions, from panic to pause, have emerged as organizations begin to assess the short- and long-term ramifications of payment change, as well as their future position in a value-driven system. Healthcare organizations should heed Bill Gates’ caution against reacting with hypersensitivity to immediate change and remaining sedentary in planning for future change: “We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten.” Organizations that are disciplined in enhancing their current circumstances while strategically positioning themselves for the long-term implications and opportunities presented by healthcare and payment reform will be successful.

This article asserts that healthcare providers and organizations cannot afford to take a holiday on long-term positioning strategies in the reform era, and thus presents key considerations that organizations must address to reach an optimal end state in a value-based world.

Healthcare providers and organizations cannot afford to take a holiday on long-term positioning strategies in an era of payment change and reform.

Implications of Payment Reform

Reformation has been a decades-long pursuit; however, participation in past efforts was urged with more of a gentle nudge than clear decree. The ACA, on the other hand, puts teeth into payment reform by way of regulatory, financial, and legislative mandates that require organizational transformation. Despite imminent change, a recent survey of hospital and healthcare system executives published by the Healthcare Financial Management Association revealed that only 20% of respondents are “very prepared,” with mechanisms in place to manage the conversion to value-based payment models effectively. This data suggests that most healthcare provider organizations are still grasping onto a fading productivity-based system and have yet to position themselves properly for imminent or long-term changes. Irrespective of beliefs or expectations regarding the immediate or enduring effectiveness of payment reform, resisting change or simply bracing for it is not sustainable – nor is it a strategy. To survive within the evolving healthcare landscape, hospitals and healthcare systems must find a way to anticipate and prepare for changes coming down the pike while simultaneously setting a strategic course for the future.

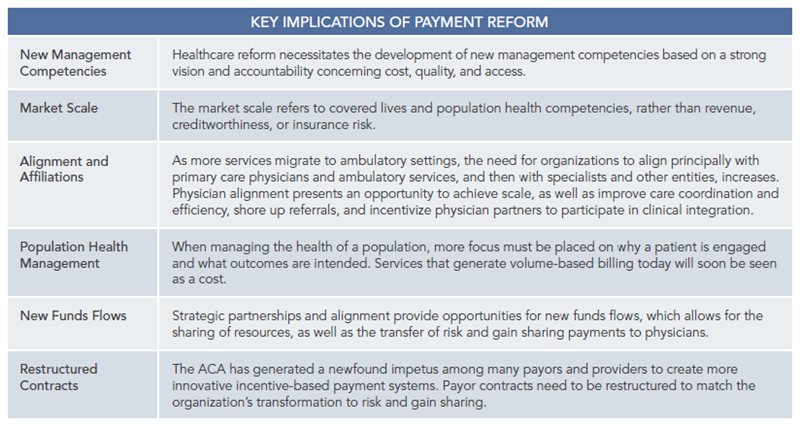

Positioning strategies that are designed to drive organizations toward a desirable future state require the incorporation of a myriad of reform implications, including those listed in the table below.

A comprehensive understanding of these critical implications is not only essential for evolving with the changing healthcare climate but pivotal in designing an organization’s long-term positioning strategies and optimal end state.

Positioning for an Optimal End State

Organizations will surely fade from the evolving healthcare landscape if they are not anchored by a shared vision of the future and commitment to achieving an attainable end state. With payment reform as the backdrop, ECG Management Consultants defines an ideal end-state model as a clinically integrated network in which organizations and providers band together to follow common clinical protocols, monitor aligned measures and incentives based on improved value, and jointly pursue payer contracts. Ultimately, effective integration can produce “strong physician-hospital links, coordinated systems of care, geographic reach, quality management, contractual capabilities, utilization controls, financial strength, organized oversight, and economy of scale.”1

An organization will surely fade from the healthcare landscape unless it is anchored by a shared vision of the future and commitment to achieving an attainable end state.

The reality is that not all organizations will survive the transition to a value-based payment system on their own and will need to band together with strategic partners. In turn, a prevailing perception within healthcare is that merger and acquisition are the obvious answers to achieving scale in order to accomplish clinical integration, expand market reach, and preserve financial strength. Though consolidation may be an appropriate course of action for certain organizations, the belief that it is the only answer or most appropriate path for all organizations is a fallacy. Scale and integration can be achieved in a variety of ways, and consolidation is merely one tactic among many that can help position organizations to realize their long-term visions.

An optimal end state represents an organization’s target destination; however, each organization possesses its own unique circumstances, characteristics, culture, and priorities, and therefore has a different vision for its ideal destination. Accordingly, positioning strategies need to be clear and tailored to fit. The merger and acquisition of hospitals, provider groups, and service providers may align with the long-term positioning strategies of some systems, whereas other organizations may not have the resources, infrastructure, or desire to pursue consolidation, and might be best served by exploring other vehicles that facilitate clinical and financial integration. Partnerships, affiliations, joint ventures, network formation, and participation in accountable care organizations represent arrangements that, when utilized effectively, can bring significant benefits to network partners and the health of a population, including greater clinical integration, geographic reach, shared costs, economies of scale, and the ability to retain some semblance of autonomy.

Participating in network arrangements offers multiple tiers of involvement – including contractor, participant, affiliate, and core roles – as well as varying degrees of ownership and exclusivity. For some organizations, the goal is to be the network core, allowing for greater influence in governance and direction setting for the provider network. In certain markets, large networks seek out smaller systems of care to bolster clinical depth and enlarge the network’s geographic footprint. In turn, smaller organizations can nest in the network’s robust care delivery system and benefit from the insurance contracts and infrastructure owned by the core. The collective aim of network partners is to capture the market share of covered lives, enhance clinical and financial integration, develop the physician alignment and clinical integration necessary to manage the care of a population, and bring that population mass to the network organization.

ECG works closely with each client to accomplish its strategic vision by defining a desirable organizational end state; identifying the core competencies and infrastructure required; evaluating the existing capabilities, culture, resources, and challenges; and designing a clear, deliberate road map toward the organization’s ideal end state.

Essential Components for an Optimal End State

Each organization is uniquely composed, thus long-term positioning strategies should be customized to fit an organization’s needs and priorities. With that said, all positioning strategies geared toward realizing an optimal end state must factor in the following five critical components, regardless of an organization’s size, scope, and scale:

- Primary Care (Physician Alignment) – Primary care needs to include the characteristics of a PCMH. Strong suitable physician partnerships are critical to driving change and protecting short- and long-term market share.

- Care Delivery Transformation – Care delivery needs to be transformed through the design of systems of care that are built to create exceptional outcomes, with an emphasis on the utilization of evidence- based practices, patient engagement, seamless care transitions, and capacity optimization.

- Payer Contract Restructuring – Systems focused on efficiencies must restructure contracts to account for a shift in payer focus and get paid for improved value. Health plans are differentiating themselves through the creation of products and spending a considerable amount of time and effort refining their strategies specific to government-mandated coverage opportunities and innovative pilots in order to protect and grow market share. As utilization is taken out of the system, organizational and provider financial performance will be at risk if contracts are not restructured. In the near term, adding sufficient size and scope to the delivery system will enhance the attractiveness to payers. In the long term, organizations should collaborate with government and private payers as well as employers to reward value and build accountability for managing healthcare quality and costs.

- IT Infrastructure – Hospitals and healthcare systems need to focus on creating an information-driven culture of integration and accountability through the development of an appropriate electronic infrastructure.

- Network Development – Attention needs to be given to growing the ACO network to align across the board as an integrated delivery network of providers and sites of care.

Developing a desirable, attainable, and sustainable end-state model will allow organizations to respond effectively to immediate changes while setting a strategic course for long-term success.

Conclusion

As system-wide payment reform transforms how hospitals and healthcare provider groups think about the provision and payment of care, success depends largely on the ability of organizations to enhance their current situations while positioning themselves for the future. Developing a desirable, attainable, and sustainable end-state model will allow organizations to respond effectively to immediate changes while simultaneously setting a strategic course for long-term success. Despite consolidation dominating the healthcare landscape, there are a number of other viable vehicles and positioning strategies that allow organizations to band together to address the ongoing opportunities and challenges they face en route to achieving an optimal end state.

Footnotes

1. B. Boone and R. Maley, “Integrated Health Care Delivery Systems’ Challenges,” International Risk Management Institute, Inc., Dallas, Texas, June 2000.