In Brief: Healthcare organizations are struggling to provide 24/7 care with fewer physicians and rising patient needs. Increasingly, advanced practice providers (APPs) are stepping into call roles once limited to doctors. We see this not as a cost-cutting move, but as a strategy to keep access open and remain compliant with the Emergency Medical Treatment and Labor Act (EMTALA). Organizations thus have an opportunity to design call pay models that recognize the expanding role of APPs and strengthen team-based care.

Factors Driving the Trend Toward Paying APPs for Call Coverage

The evolving demands of modern healthcare delivery are reshaping the roles and responsibilities of APPs, and health systems are turning to APPs to fill critical coverage gaps. Several key factors are contributing to the growing trend of compensating APPs for providing call coverage.

1. Physician Shortages and Burnout

National physician shortages, particularly in rural regions, are forcing healthcare systems to explore alternative coverage models. Some rural hospitals have only one or two physicians in a given specialty, if any at all. In these environments, APPs trained in specialty care are increasingly used as first-call responders for emergency and inpatient needs. Utilizing APPs for call coverage not only helps reduce physician burnout and maintain continuity of care across nights, weekends, and holidays, but also contributes to physician recruitment and retention by supporting more sustainable call schedules.

2. Expansion of APP Scope and Autonomy

Many states allow APPs to diagnose, treat, and prescribe independently or with minimal supervision. In settings with limited physician availability, APPs are often the most immediately available providers for urgent or emergent care. As they take on more complex patient management responsibilities, often without on-site physician presence, compensating APPs for call is both a practical and equitable step that reflects the nature of their clinical contributions.

3. 24/7 Access Demands

Modern care models assume around-the-clock provider access, a reality intensified by regulatory frameworks like EMTALA. EMTALA requires Medicare-participating hospitals to screen and stabilize all patients with emergency medical conditions and maintain a list of on-call physicians. Although the Centers for Medicare & Medicaid Services (CMS) does not mandate 24/7 specialty coverage, rural hospitals striving to avoid patient transfers often rely on APPs to maintain functional coverage (both restricted and unrestricted). Properly structured APP call schedules, separate from physician call lists, can help hospitals meet EMTALA obligations while limiting compliance risks.

How Organizations Are Designing APP Call Coverage

APP call coverage compensation structures vary significantly across organizations and specialties. In ECG’s experience, these arrangements are typically driven by a combination of call burden, APP autonomy, local market pressures, and service line needs. While benchmark data for APP call pay remains limited, many organizations are taking proactive steps to establish equitable and transparent compensation models.

1. Embedded in Base Salary

Some organizations treat call coverage expectations as part of base compensation, and this can work well when all APPs within a specialty share the call coverage duties in an equitable manner. However, when embedding call coverage into base expectations, it is important to consider adjusting clinical productivity or patient-facing hour requirements to reflect the added burden of call responsibilities and remain aligned with market expectations.

While there are limitations in APP call coverage data, the value of call coverage is included in total cash compensation (TCC) benchmark data for APPs who provide it. Specialties where APPs frequently take call coverage, such as orthopedic surgery and neurosurgery, often report higher TCC, likely due in part to the additional emergency call responsibilities associated with these specialties. However, given the variability in call coverage obligations and burdens/intensities across organizations, the value of call coverage compensation in TCC may be understated.

Lastly, if embedding call coverage in base salary, consider that the call coverage rotation is often lower for APPs than for physicians. For example, the call rotation for physicians typically ranges from five to ten shifts per month (which varies based on specialty); however, the call rotation for APPs ranges from four to seven shifts per month.

2. Separate Call Pay from Day One

In specialties where only certain APPs from the specialty group take call, it is often more appropriate to use separate stipends or hourly/shift call pay models, rather than embedding call into base compensation.

Typical day one call pay structures include:

- Annual stipends: These work well for teams with consistent and evenly distributed call schedules.

- Daily stipend or hourly rate model: This model enables organizations to remain flexible and align with call coverage provided. Some organizations may still define a minimum expectation of APP call shifts (e.g., four shifts per month) but otherwise allow APPs to take more or less call and be compensated accordingly.

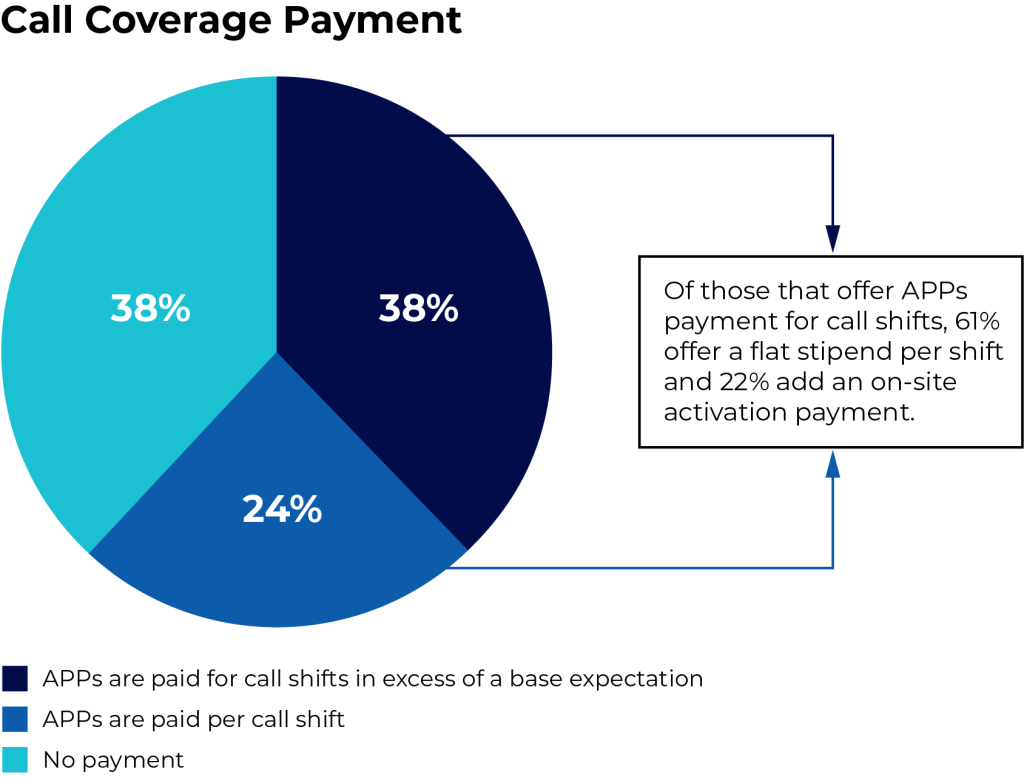

This is the most prevalent model, based on a survey conducted by ECG. Of those that offer APPs payment for call shifts, 61% provide a flat stipend per shift, and 22% add on-site activation payment, highlighting the growing trend toward structured, scalable payment models. - Activation-based payments: These payments distinguish between the burden of being available (i.e., standby time) and responding to activations. Many organizations prefer flat-rate activation pay for administrative and budgeting simplicity. Consider that physicians on a production-based compensation plan will often receive WRVU credit for services provided while on call, even when they are activated. As production-based compensation models are not a common standard for APPs, particularly in the surgical and procedural specialties that are using APPs for call, APPs are often not eligible for this incentive while on call. That said, these models can be beneficial in specialties with low activation rates but high burden when activated.

Each of these models enables scalable, defensible compensation that evolves in tandem with program maturity and data availability. However, the long-term adaptability of each model can vary. Transitioning from one approach to another (e.g., from a day-one call stipend to embedding calls in base compensation) may be operationally challenging and require careful change management.

Key Considerations for Implementing APP Call Pay

As healthcare organizations increasingly compensate APPs for call coverage, it is crucial to implement these arrangements thoughtfully and in compliance with relevant regulations. Several factors must be considered to ensure these programs are sustainable and defensible.

The following considerations can help guide organizations structure APP call pay models properly.

1. EMTALA Compliance

Hospitals must take care when integrating APPs into call programs, especially in the emergency department (ED). EMTALA requires hospitals to maintain a list of physicians on call, and CMS has clarified that APPs cannot be listed as the first-call provider on the ED’s physician call schedule. However, organizations may list APPs on a separate APP call schedule to supplement care availability, provided this is permitted under the organization’s medical staff bylaws.

In scenarios where an on-call physician delegates a response to an APP, this must follow consultation with the ED and align with written protocols. Separate but coordinated APP and physician schedules can demonstrate EMTALA compliance while preserving flexible coverage.

2. Fair Market Value and Commercial Reasonableness

Like other compensation components, call coverage payments must be factored into meeting fair market value (FMV) standards and ensuring commercial reasonableness (CR). Relevant considerations include the following:

- Impact on Physician Call Coverage Compensation: If APPs are reducing the burden on physician call pools by acting as first-line responders, the rate paid to physicians for call coverage may need to be adjusted accordingly, either through a reduction in per diem or base salary expectations.

- Level of Responsibility and Burden: Assess the scope of services that APPs provide while on call, including response expectations, patient acuity, and the level of decision-making required without direct physician oversight.

- Consistency with Organizational Resources: The use of APPs for call coverage should be commercially reasonable, meaning it aligns with the organization’s size, acuity level, and available workforce, and would still be appropriate even in the absence of a financial incentive.

- Alignment with Care Delivery Model: The arrangement should support the organization’s care delivery structure, such as team-based care or hospitalist models, rather than being structured solely to generate referrals.

- Legitimate Need for Coverage: The organization must demonstrate a bona fide operational need for APP call services, such as gaps in physician availability or patient volume that require additional coverage.

- Regulatory and Legal Considerations: While APPs are not directly covered under the physician self-referral law (Stark Law), their involvement in call coverage arrangements could still raise compliance issues if the structure indirectly benefits referring physicians. For example, if APPs are hospital-employed and reduce call burden or service demands for independent physicians, this could be viewed as indirect remuneration and may raise concerns under Stark or the Anti-Kickback Statute, depending on the arrangement’s structure and intent.

3. Market Competitiveness

To attract and retain skilled APPs, healthcare organizations must carefully consider how their call pay structures compare with those of other organizations in the local and regional market. Competitive compensation not only reflects the value of APP contributions but also helps prevent turnover and gaps in coverage. Organizations should conduct regular market benchmarking to understand prevailing rates for call pay and adjust their offerings accordingly. Structuring call pay in a way that aligns with market standards ensures that APP compensation remains fair, sustainable, and appealing to current and prospective providers.

4. Call Type and Burden/Intensity

Not all call is created equal. In the outpatient setting, practice call is a standard expectation of APPs and is most often incorporated into base salary, with coverage expectations aligned to those of their physician counterparts. Other APPs are expected to triage, admit, or actively manage complex inpatients. Organizations should document the frequency, intensity, and time commitment of activations to calibrate appropriate compensation.

5. Scope of Practice and Supervision

Compensation models should reflect the APP’s licensure, state-specific scope of practice, and actual responsibilities during on-call hours. For example, states that require collaborative agreements may necessitate oversight protocols that influence both clinical structure and payment design.

Designing New Payment Models

Designing compliant, equitable APP call programs requires more than intuition. It demands expertise in FMV, CR, legal risk mitigation, and operational design.

To get started, organizations should:

- Assess current coverage models to identify inconsistencies in how APP call responsibilities are structured and compensated.

- Benchmark compensation against peer organizations to ensure competitiveness and compliance.

- Establish clear governance pathways for approving, reviewing, and adjusting APP call pay as roles evolve.

Looking for expertise in APP compensation model design?

Learn about our provider compensation planning and valuation services.